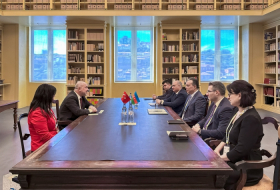

IFC, in partnership with the State Secretariat for Economic Affairs of Switzerland SECO, will be working with the Azerbaijan Banks Association, a national body that represents the country’s lenders. IFC will advise the association on how to develop a suite of modern digital financial services that will contribute to financial inclusion and modernization.

The collaboration aims to make it easier for individuals and small businesses, especially those in rural areas without bank branches, to set up savings accounts and secure loans. The project will also help raise awareness of digital and electronic products.

“Technology has the potential to modernize the way people in Azerbaijan access financial services,” said Zakir Nuriyev, President of the Azerbaijan Association of Banks. “This partnership with IFC will help local financial institutions develop industry-leading products, allowing them to meet the fast-changing needs of their customers.”

The initiative, formally known as the Electronic and Digital Financial Services Project, is part of the broader World Bank Group strategy to help diversify Azerbaijan’s economy and spur economic growth, in this case through support for electronic and mobile banking services. Extending the reach of banking institutions to remote areas also delivers on the future promise and potential of digital banking.

“By giving small businesses and entrepreneurs – especially those outside the oil sector – increased opportunities to access financial services, we can help them expand and create jobs,” said Aliya Azimova, IFC Country Representative in Azerbaijan. “That is key to fighting poverty and building a sustainable economy in Azerbaijan driven by non-oil private sector.”

The country recently introduced new rules allowing customers to open accounts distantly. The novelties aim to extend the reach of banking institutions in remote areas, helping Azerbaijan, among other reformers in the area, further advance along the path to digital banking.

More about: #Azerbaijan