Oil prices drop on production-freeze pessimism

Oil prices fell on Wednesday as profit-taking and pessimism over whether major crude producers can agree to a production freeze brought the price down from its highs on Tuesday, AzVision.az reports citing Wall Street Journal.

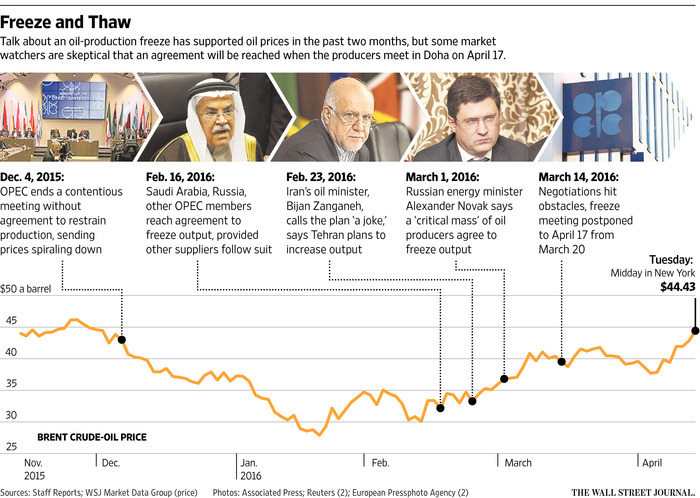

Crude prices were lifted Tuesday to the highest level of the year, amid speculation that Saudi Arabia and Russia had already reached a deal to stabilize production ahead of a meeting of key oil producers in Doha, Qatar, this weekend.

But Saudi Arabian Oil Minister Ali al-Naimi dismissed this idea, telling the Saudi al-Hayat newspaper to “forget this topic.”

The coming Doha meeting is dominating market sentiment and will continue to do so for the rest of the week, according to Morgan Stanley. But if a deal is agreed, any upside would likely be limited to current price levels, the bank said in a research note.

“The bear case is that the deal falls apart (low odds in our view), but we would still expect positive spin and a commitment to continue talks.”

While markets should expect continued volatility as the weekend approaches, the mood is more bullish looking toward the summer, analysts say.

Bjarne Schieldrop, commodities analyst at Sweden’s SEB Bank, said there is evidence that the supply-demand balance is starting to shift, amplified by accelerating production declines. Falling output in the U.S. and Latin America, plus maintenance stoppages in the North Sea, will provide an effective tailwind and tighten supply going into the summer.

In the immediate term, investors and traders will continue to eye weekly U.S. crude production and inventories data for clues. The Energy Information Administration will report data later Wednesday.

A survey industry analysts by The Wall Street Journal predicts U.S. crude stockpiles likely added 1.8 million barrels last week, while gasoline supplies fell.

The American Petroleum Institute, an industry group, expects a 6.2-million-barrel increase in crude supplies, a 1.6-million-barrel drop in gasoline stocks and a 530,000-barrel decrease in distillate inventories.