Mr. Powell is unlikely to respond to the decline in stock prices unless it worsens dramatically. In remarks after his swearing-in as Fed chairman, he emphasized the health of the economy.

“Today, unemployment is low, the economy is growing and inflation is low,” Mr. Powell said in a brief video statement that the Fed published on its website. “Through our decisions on monetary policy, we will support continued economic growth, a healthy job market and price stability.”

The stock market declined 35 percent in the three months after Alan Greenspan became Fed chairman in August 1987, including the “Black Monday” crash in mid-October. Mr. Greenspan responded by sharply cutting the Fed’s benchmark interest rate and issuing a public statement declaring that the Fed was ready and willing “to support the economic and financial system.”

The intervention, which reversed the decline, was celebrated at the time, but it contributed to an expectation in financial markets that Mr. Greenspan would not allow stock prices to fall.

Continue reading the main story

RELATED COVERAGE

Dow Jones and S.&P. Slide Again, Dropping by More Than 4% FEB. 5, 2018

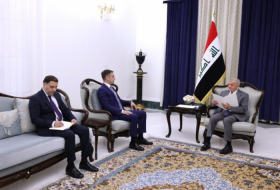

Powell Takes Over as Fed Chief as Economy Starts to Show Strain FEB. 4, 2018

The current downturn is much smaller. The Standard & Poor’s 500-stock index is down 6 percent since Thursday. Mr. Powell said on Monday that the economy is in good health. With unemployment low, the Fed is focused on raising its benchmark interest rates to stay ahead of inflation.

“Powell could have done without a slump in the U.S. stock market, but unless the slump becomes a rout, he is unlikely to intervene,” wrote John Higgins, an economist at Capital Economics.

The Fed’s enforcement action against Wells Fargo on Friday is another new addition to Mr. Powell’s plate. The Fed halted the bank’s growth until it improves its internal checks and balances, a move that comes as the Fed’s seven-member board is down to just three governors, the smallest number in the institution’s history.

In addition to Mr. Powell, the members of the board are Randal K. Quarles, the vice chairman for supervision, and Lael Brainard.

Mr. Quarles, who oversees financial regulation issues at the Fed, has recused himself from Wells Fargo-related business because he held significant investments in the firm before he joined the Fed last year. That leaves Ms. Brainard, the other member of the committee that oversees supervision, as the Fed’s point person on the Wells case, although Mr. Powell would also participate in significant decisions.

Other Fed governors could be arriving. President Trump has nominated Marvin Goodfriend, a conservative economist, to join the board. He is awaiting Senate confirmation.

Mr. Trump has not announced nominees for the other three seats on the board.

The regulators who directly supervise Wells Fargo are employees of the Federal Reserve Bank of San Francisco, one of the 12 regional banks that make up the Fed system. Before the 2008 financial crisis, the regional reserve banks exercised significant control over the institutions headquartered in their regions. But in 2010, the Fed centralized the regulation of large banks to improve the consistency of regulation and to take a broad view of issues affecting multiple banks.

The judgment about Wells Fargo’s progress will be made by a staff committee, the Large Institution Supervision Coordinating Committee, that is led by Michael S. Gibson, the Fed’s director of supervision and regulation, in close consultation with the board of governors.

Wells Fargo has been through this process once before. The company was censured in December 2016 for failing to file an adequate plan for dealing with a financial crisis.

Mr. Powell was sworn into office by Mr. Quarles, a longtime friend. When Mr. Powell worked as a senior Treasury Department official under President George Bush in the early 1990s, he hired Mr. Quarles as an assistant. Later the two men worked together at the Carlyle Group, a private equity investment firm.

Mr. Quarles was selected by Mr. Trump as the Fed’s point man for an overhaul of post-crisis financial regulations, which the president views as excessive. Mr. Powell on Monday reiterated his view that the financial system “is now far stronger and more resilient” as a result of increased regulation and “we intend to keep it that way.” He added that there is room for improvement to make regulation “efficient as well as effective.”

More about: FED