by Jonathan Woetzel & Mekala Krishnan

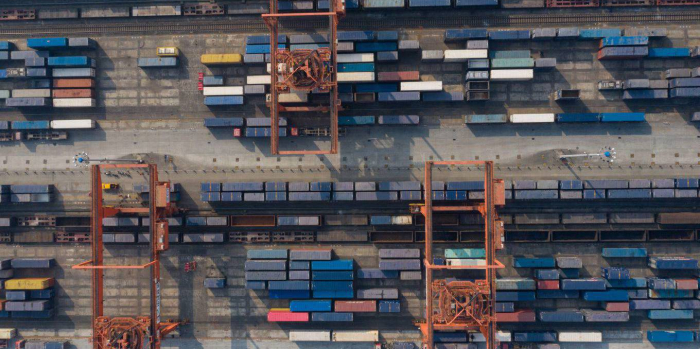

For the last 25 years, revolutions in communication and transportation technologies have allowed companies to create truly global value chains. Those processing raw materials were linked up with manufacturers of inputs and parts, which were in turn linked to the companies that assemble and package final products, and then to distribution channels extending to consumers around the world.

In the two decades before the COVID-19 pandemic, the annual value of intermediate goods exported across borders tripled, to more than $10 trillion,giving rise to an intricately choreographed production system. But, because these global networks have evolved to reduce costs through maximum efficiency, they can be brittle, and sometimes will snap under pressure.

Hence, every country involved in the world’s production networks must understand its risk exposure, and build more resilience where it is needed. For emerging economies seeking to expand export-oriented manufacturing, the implications of this global reckoning could be far-reaching.

True, the pandemic has not yet reshaped industry footprints dramatically. But that is not surprising: global supply chains reflect economic logic, hundreds of billions of dollars of investment, and longstanding supplier relationships. Changing the geography of production is not easy when major multinationals’ supplier networks encompass thousands of independent companies, each with its own specialized contribution.

Still, as we have seen, far-flung global supply chains can be vulnerable to all types of disruptions, from natural disasters to cyberattacks and trade disputes. The COVID-19 pandemic drove home this point as it forced manufacturers to manage workforce health and safety issues, planning and logistical difficulties, shortages of materials and parts, unpredictable spikes and drops in demand, and cashflow problems.

Companies cannot assume a return to smooth sailing after the pandemic. In a recent survey of supply-chain executives, the McKinsey Global Institute found that disruptions lasting a month or longer now occur every 3.7 years, on average, imposing steep financial costs. Adjusted for the probability and frequency of disruptions, companies can expect to lose more than 40% of a year’s profits every decade (based on a model informed by the financials of 325 companies across 13 industries). Moreover, a single severe shock causing a 100-day disruption could wipe out an entire year’s earnings or more in some industries. As we have just learned the hard way, events of this magnitude can and do occur.

With companies and governments reassessing how goods flow across borders, some will make targeted adjustments to source goods from places they perceive as less risky. To understand how such decisions might play out, MGI examined the feasibility of movement based on industry dynamics, as well as the possibility that governments might intervene to support the domestic production of goods they deem essential or strategic. All told, we estimate that up to one-quarter of global goods exports – worth $2.9-4.6 trillion annually – could feasibly shift to different countries in the next five years or so, though the potential varies considerably across industries.

This movement need not lead to a wave of reshoring to advanced economies, particularly if it encourages “nearshoring,” or movement from one emerging economy to another. Nonetheless, it does create new imperatives for emerging economies that are eager to add jobs and develop their industrial base through export growth. Much of the manufacturing that takes place in developing economies is for local consumption, and these operations will likely stay put. The question is whether these countries can retain their share of global exports, or even capture a bigger share as companies revisit sourcing decisions.

For years, developing countries have been advised that competing solely on the basis of low-cost labor is not enough; they must boost productivity, develop the skills base, and improve production quality. And now, this list will be expanded to include resilience. Countries that want to maintain their positions in global value chains – or even capture a share of the production that could be in play – will need to assess their own risk exposure and cultivate the capabilities to withstand disruptions and recover from them quickly.

Emerging economies in Asia, for example, are highly exposed to a wide range of risks such as typhoons, severe flooding, earthquakes, tsunamis, and heat stress. Manufacturers across the region may need to shore up their factories and warehouses to withstand storm surges that could worsen in the coming years as climate risk intensifies. This may involve installing bulkheads, elevating critical machinery, adding more waterproofing, and reworking drainage. Factories that are not air-conditioned will need cooling systems to prepare for rising temperatures and more frequent heat waves. Plants located in earthquake-prone areas may need seismic retrofitting.

For their part, multinationals will need to make their supply chains more stable, transparent, and sustainable, and the best way to do that is with technology. Connecting entire production networks from end to end can provide the exact location and timing of shipments and make visible in real time risks brewing on the horizon. As more physical assets are digitized, however, companies will need workers with the relevant technical skills, along with greater investments in cybersecurity.

Supply-chain resilience is also an issue for the public sector. Physical infrastructure systems will need to be built and adapted to withstand whatever nature or various bad actors throw at them. Given the experience of the past year, governments must ensure robust digital networks, early-warning systems, and emergency-management capabilities.

The pandemic has delivered a wake-up call. Cost structures are changing across countries, and new technologies are gaining traction in global manufacturing. These developments could set the stage for supply chains to become more secure and productive; but emerging economies will need to prioritize their own resilience in order to claim a bigger share of global production.

Jonathan Woetzel, a McKinsey senior partner, is Director of the McKinsey Global Institute and co-author of No Ordinary Disruption: The Four Global Forces Breaking All the Trends.

Mekala Krishnan is a partner at the McKinsey Global Institute.

Read the original article on project-syndicate.org.

More about: