The overarching message from the Americans is that China needs to make profound changes in its economic model so that growth is powered by consumer spending rather than by investment and exports, he said.

"You need to not be doing quick fixes in terms of using your exchange rate or exports," Furman said in an interview with Reuters.

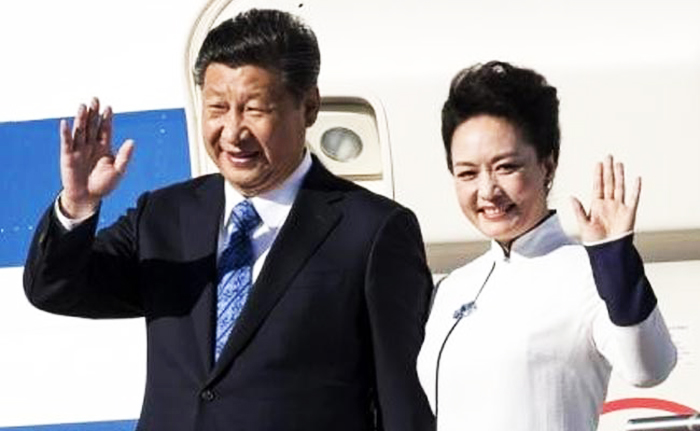

Xi and President Barack Obama are expected to have intense talks about cyber espionage during the Chinese leader`s time at the White House on Thursday and Friday, but economic issues are also expected to be high on the agenda.

Furman said the White House, which is concerned that economic fragility abroad will taint U.S. growth, had been monitoring fluctuations in Chinese stock markets closely.

"It`s certainly something we pay attention to and it`s something we`ll be engaging with President Xi on this week," he said.

China shocked investors in August by allowing the yuan to devalue sharply. Many analysts took this as a sign China`s leaders were so worried about a slowing economy that they wanted a weaker currency to prop up exports.

Beijing said the shift was part of a currency reform, but U.S. officials have bristled over what they saw as opacity.

"It`s not consistent with a transparent rules-based international system," Furman said.

A senior U.S. Treasury official said last week that since the devaluation in August, Chinese authorities have been intervening to stem losses in the yuan, which has been under pressure due to doubts over China`s growth prospects.

Critics for years complained that China kept its currency artificially weak to boost exports.

America is pressing Beijing to enact fiscal stimulus measures that would boost household consumption.

"What we`re asking is for China to play a responsible role in the global economy and to expand consumer spending and support its growth through consumer spending," Furman said.

More about: