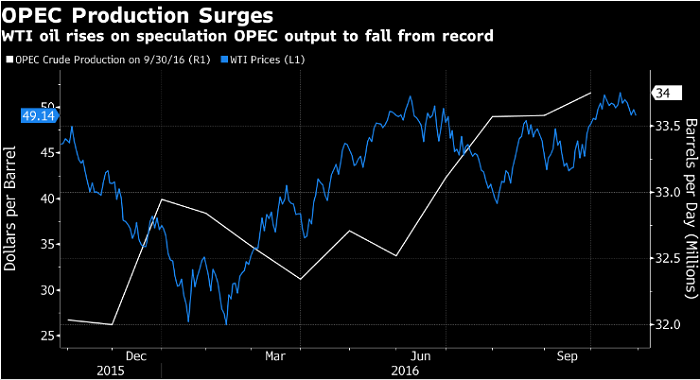

The Organization of Petroleum Exporting Countries agreed in the Algerian capital last month to trim production to a range of 32.5 million to 33 million barrels a day, and is due to finalize the deal at a Nov. 30 summit in Vienna. The accord helped push oil prices to a 15-month high above $50 a barrel earlier this month, although they have subsequently fallen amid doubts the group will follow through on its pledge. More than 18 hours of talks over two days in the Austrian capital this weekend yielded little more than a promise that the world’s largest producers would keep on talking.

"It might be impossible for OPEC to come to an agreement on making cuts," said Mark Watkins, the Park City, Utah-based regional investment manager for The Private Client Group of U.S. Bank, which oversees $136 billion in assets. "The best that can realistically be expected is a freeze. Iran, Libya and Nigeria will probably be allowed to raise production to pre-disruption levels."

OPEC signaled last month that Iran, Nigeria and Libya would be spared from any cuts, due to sanctions and security issues that have curtailed their output. Iraq, citing its war with Islamic State militants, wants similar treatment.

"There’s plenty of time for the market to shift, and perhaps shift again before the meeting on Nov. 30," said Tim Evans, an energy analyst at Citi Futures Perspective in New York. "Even the official OPEC meeting might not answer all the questions we have. We’ll need additional time to evaluate compliance with the agreement and see if it has any actual impact on the market."

Shifting Market

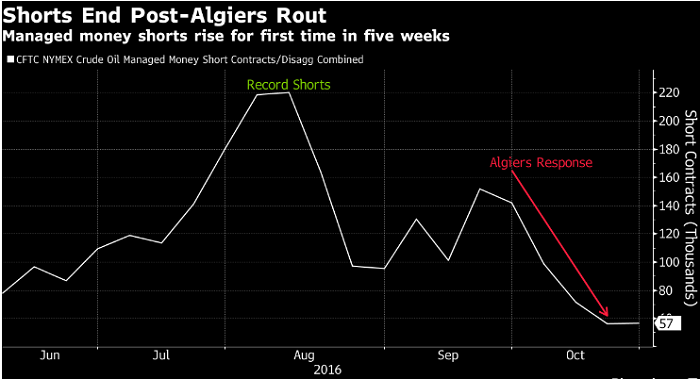

In addition to increasing short positions in WTI in the week ended Oct. 25, hedge funds reduced their long positions, or wagers that prices will rise, Commodity Futures Trading Commission data show. The resulting net-long position decreased 8 percent.

WTI dropped 0.7 percent to $49.96 a barrel in the report week. Prices slipped a second day on Monday, dropping 0.4 percent to to $48.52 a barrel as of 12:09 p.m. Singapore time.

"Right now it’s not looking good but these things always go right down to the wire," said Mike Wittner, head of oil-market research at Societe Generale SA in New York. "There’s an awful lot at stake here. If they don’t reach an agreement oil will fall like a rock and be testing $40 in no time."

OPEC’s 14 members pumped a record 33.75 million barrels a day in September, according to Bloomberg estimates. Iraqi production climbed to a record 4.54 million barrels a day last month while Iranian output rose to 3.63 million, the highest since June 2011.

"OPEC total production might still be rising," Evans said. "It looks like there’s some added output in both Nigeria and Libya, so we might find out that OPEC production reached another record high in October. That would underscore the challenge OPEC faces and ratchet up the pressure."

Money managers’ short position in WTI climbed 0.4 percent to 56,563 futures and options, the CFTC said. Longs fell 6.6 percent, the most since August.

In fuel markets, net-bullish bets on gasoline rose 1.6 percent to 40,730 contracts, the highest since March 2015, as futures slipped 0.4 percent in the report week. Wagers on higher ultra low sulfur diesel prices climbed 46 percent to 12,356, the highest in two months. Futures declined 0.4 percent.

OPEC is seeking the backing of non-members for production cuts to support oil prices. Russian President Vladimir Putin suggested in Istanbul on Oct. 10 that his country was prepared to reduce supply, only to add two days later that it would refrain from further increases at most.

"I still think there’s going to be an agreement because there’s too much at stake," Wittner said. "If there’s no progress in the short term I think you will see Saudi Arabia, Russia, Iran and Iraq get together and thrash out a deal. The four countries have incentives to come to an agreement before Nov. 30."

More about: