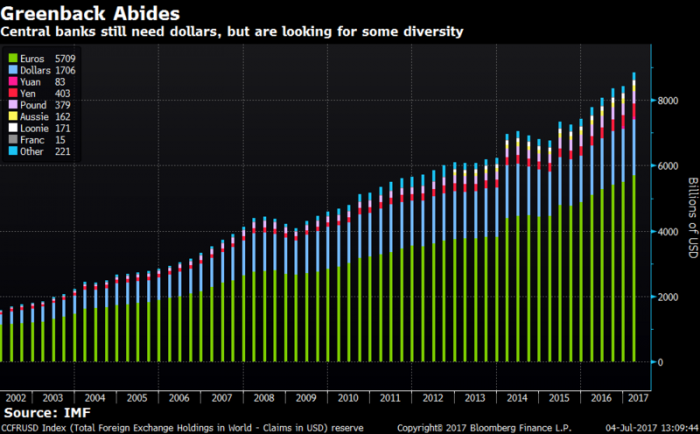

The following charts highlight the changing dynamics for one of the largest pools of buy-and-hold investors.

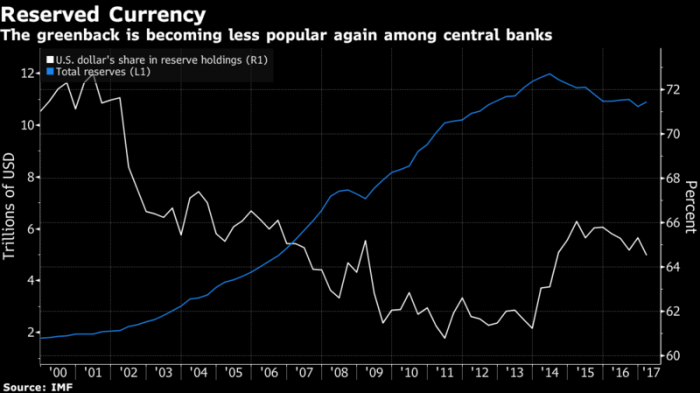

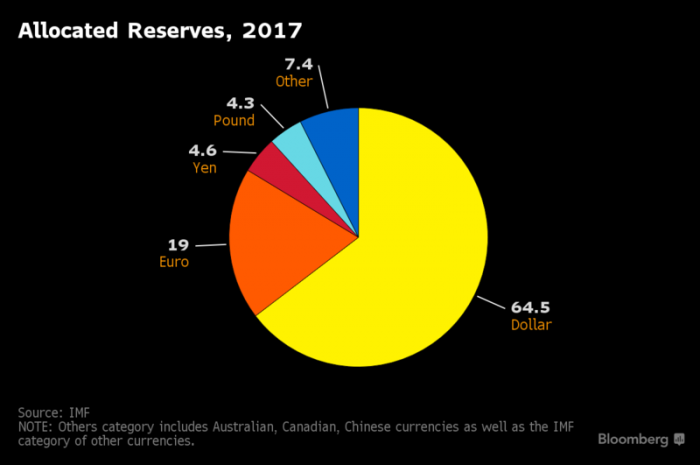

Higher interest rates at the Federal Reserve haven’t done much to boost the dollar’s dominant role in central bank reserves. After climbing to an 8 1/2-year high of 66 percent at the start of 2015, the greenback has subsided to 64.5 percent even amid the first rate hikes for more than a decade.

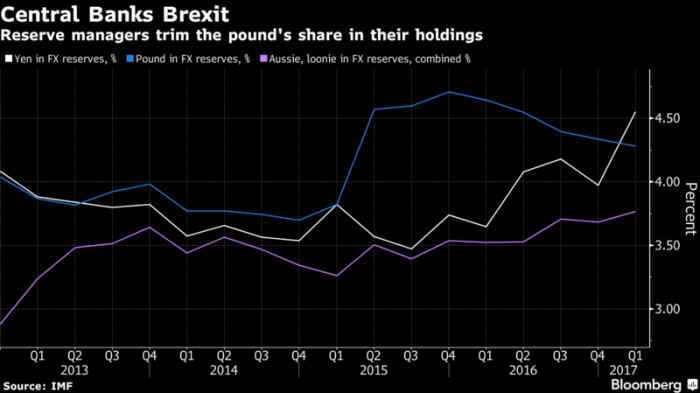

U.K. voters certainly did the pound no favors when they decided to quit the European Union a year ago. Sterling slid by a record and one-day volatility spiked to an unprecedented 100 percent -- not the sort of behavior central banks look for, so they’ve kept on paring the pound’s share in their holdings. The yen has been among the beneficiaries.

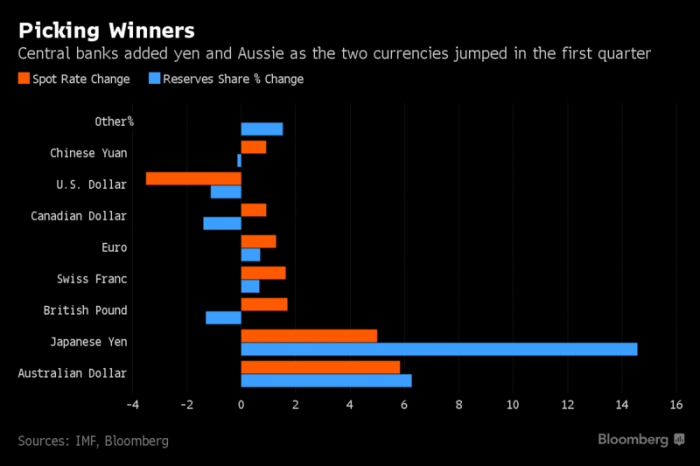

Speaking of the yen, it stands out along with the Aussie as the big mover in the first quarter when it comes to a share in reserves -- and the same goes for their performance in the period. They each had a much quieter second quarter, so it is possible central banks cooled on them and instead decided the euro (up 7.3 percent) was the place to be.

Looking at the longer term picture, the euro is the main currency to have gone backwards, while a collection of smaller players -- Aussie, loonie, the yuan and others -- have grown to between them carry more weight than the pound or the yen.

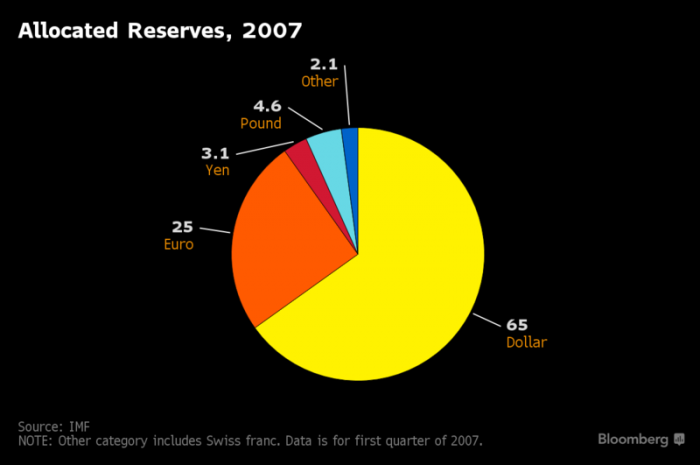

Looking back to 10 years ago, before the global financial crisis that sparked the steepest economic slowdown since the Great Recession, it seems the dollar is back now where it was then. The euro, on the other hand was a lot more popular before the strain of dealing with the meltdowns in Greece, Ireland, Portugal, Spain and so on led to speculation the common currency would be broken up.

Looking at the longer term, the big picture shows that central banks have been adding and adding to their holdings, and that the U.S. dollar remains the preeminent reserve currency.

More about: #dollar