Why so? Well the answer comes in three parts. First, this has all the characteristics of a classic financial bubble. Second, bitcoin does not have the classic qualities that define successful currencies. And third, it has a certain elements that have made it unusually durable, and indeed useful, which have allowed it to become as sought-after as it has.

The bubble aspect is easy to sketch. Throughout history there have been financial bubbles, where something intrinsically not very valuable gets driven to what subsequently seem ridiculous heights. The classics include the Dutch tulip craze of 1636/7, the South Sea bubble of 1720, the railway boom of the 1840s, Wall Street in the 1920s, and within our memories the dot-com boom of 1998/9.

Usually there is some method in the madness. Railways did transform the world and we still live with the benefits of the dot-com boom. But a lot of late investors in both the railways and the dot-com companies lost their shirts.

Sometimes, however, there is no reason – just pure speculation. What we can be pretty sure of is that this is classic bubble territory.

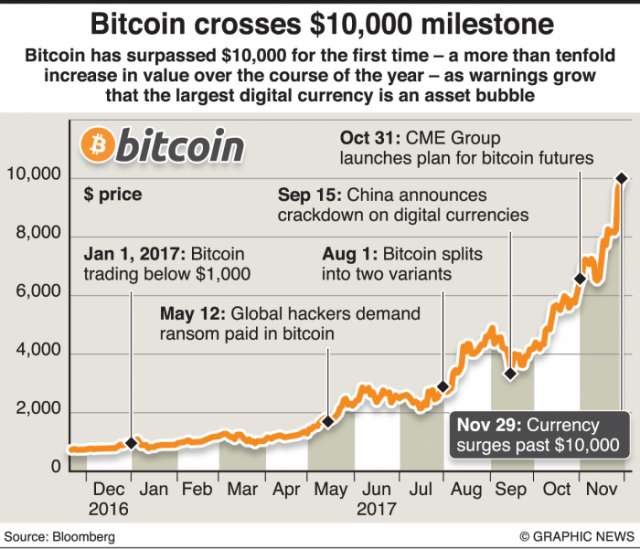

Bitcoin is an entity that few people can explain. It was worth less than 10 US cents in 2010, less than $10 in 2012, but had risen to $750 a year ago and now to $10,000 plus. This is the Zimbabwe dollar in reverse.

That leads to the second point. We know a lot about currencies, for they have been around in some form or other for at least 7,000 years. Classic monetary theory holds that they have three characteristics: they are a medium of exchange, a denominator of value and a store of wealth. (Some people add a fourth, a standard of deferred payment, but let’s keep it simple.)

Most currencies do the first two pretty well, because that is how we use money every day and know and compare the prices of the things in the supermarket.

They do the third worse, as those of us who were around in the late 1970s and early 1980s, with inflation at more than 20 per cent a year, well remember.

Nowadays we don’t keep too much of our savings in cash, particularly since it earns such a dreadful return in the bank. But in a world of low inflation and for short periods at least, it is an OK store of value.

But – and this is the point – bitcoin does none of these functions well. It is not much use as a medium of exchange because it is not even now widely accepted. It is not a denominator of value at all, because its own value has whizzed about so much. And it is not a store of value because it has become too valuable in itself.

Paradoxically, it has been too good a store of value (if you trust present valuations) to perform the necessary function of money.

So why has it been so successful? None of us fully know the answer to that, but it has I think two seductive qualities.

One is that few people understand it. Most people don’t understand conventional finance, and those people include the bankers who ramped up the 2007/8 financial crash. But here are some high-tech visionaries who seem to know what they are doing, and they cannot be any worse than the bankers, can they?

The other is that it is below the radar. The world of officialdom hates it. The world of counter-culture loves it. You can’t tax it, you can’t trace it – qualities that make it attractive not just to terrorists or drug dealers, but to anyone with a streak of cussedness in them. Most of us have a little bit of that, don’t we? It would be a sad old world if we didn’t.

But it will end in tears. The question then is how serious the impact will be on the world economy as a whole.

In this respect, I am (I hope rightly) reasonably optimistic. The first reason for that is that bitcoin is quite small. Right now the total value of all the bitcoin is a bit shy of $200bn. That sounds a lot but actually it is pretty small in terms of the global economy. It is the GDP of Greece. The world economy grows by quite a lot more than that amount every month. Take that out and if there were a serious downturn as a result, the world’s central banks could agree to add that extra cash over a weekend.

So in macro-economic terms, a crash in bitcoin would not matter. But if you were one of those clever people who spotted its potential a year or more ago and did something about it, that outcome would not be a bundle of fun.

The original article was published in the Independent.

More about: #Bitcoin