The political upheaval and social unrest fueling the current crisis in Italy should surprise no one. On the contrary, the only uncertainty was when exactly matters would come to a head. Now they have.

Italy’s per capita GDP in 2018 is about 8% below its level in 2007, the year before the global financial crisis triggered the Great Recession. And the International Monetary Fund’s projections for 2023 suggest that Italy will still not have fully recovered from the cumulative output losses of the past decade.

Among the 11 advanced economies that were hit by severe financial crises in 2007-2009, only Greece has suffered a deeper and more protracted economic depression. Greece and Italy were the two economies carrying the highest debt burdens at the outset of the crisis (109% and 102% of GDP, respectively), leaving them poorly positioned to cope with major adverse shocks. Since the crisis erupted a decade ago, economic stagnation and costly banking weaknesses have propelled debt burdens higher still, despite a decade of exceptionally low interest rates.

Greece has already faced more than one “credit event” and, while Italy has also had a couple of close calls, the spring of 2018 is turning out to be its most tumultuous episode yet. The summer will probably be worse, bringing Italy closer to a sovereign debt crisis.

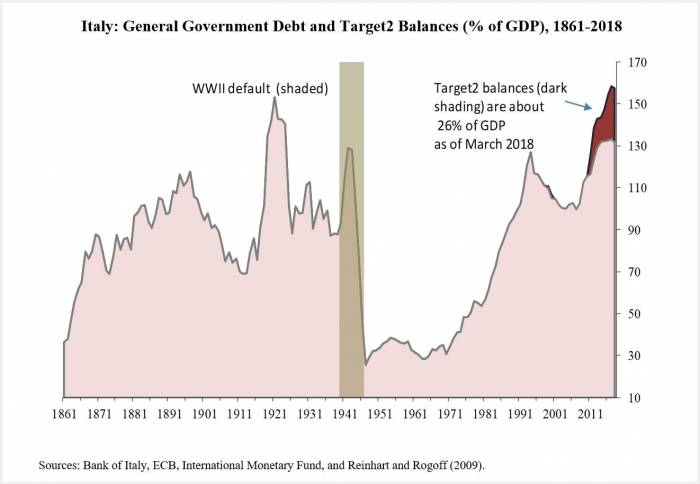

On the surface, general government debt appears to have stabilized since 2013, at around 130% of GDP. However, as I have stressed here and elsewhere, this “stability” is misleading. General government debt is not the whole story for Italy, even setting aside the private debt loads and the recent renewed upturn in nonperforming bank loans (a daunting legacy of the financial crisis).

When evaluating Italy’s sovereign risk, the central bank’s debts (Target2 balances) must be added to those of the general government. As the most recent available data (through March) show, these balances increase the ratio of public-sector debt to GDP by 26%. With many investors pulling out of Italian assets, capital flight in the more recent data is bound to show up as an even bigger Target2 hole. This debt, unlike pre-1999, pre-euro Italian debt, cannot be inflated away. In this regard, it is much like emerging markets’ dollar-denominated debts: it is either repaid or restructured.

Severe political uncertainty against a backdrop of chronic slow growth and a sovereign-debt level currently hovering around 160% of GDP already is enough to trigger a debt crisis. Adding to these fundamentals, populist rhetoric about introducing a quasi-currency or small-denomination IOUs (presumably to finance ambitious spending plans and larger budget deficits), and about not honoring the Bank of Italy’s debt, adds fuel to the financial fire.

Italy’s instability is already having international repercussions, and the current bout of global uncertainty is far from over. Close to home, as Italian bond yields climb and oscillate with the rumor mill, yields for Spanish, Portuguese, and Greek bonds have been driven higher. Moreover, the Italian story is unfolding as Greece closes in on an agreement in June about its exit late this summer from dependence on Europe’s bailout framework. One can only hope that political contagion from Italy does not further complicate these negotiations.

Farther afield, the weakness in the euro has translated into dollar strength, which means a sustained beating for emerging markets, particularly those with US dollar debt. The flight to quality that accompanies outbreaks of financial turbulence is reinforcing a shift away from some of the riskier asset classes of which emerging markets are a part. International equity markets have not been exempt from contagion.

How do such episodes typically end? The most desirable outcome – rapid resolution that places the source of contagion on a sustainable growth path – appears improbable in Italy’s case. Meaningful debt renegotiations are seldom swift: creditors want repayment, and debtors want a write-down. As Christoph Trebesch and I have documented, negotiations seldom get it right on the first – or even the third – try. Initial restructuring agreements tend to fall short of the magnitude needed to achieve debt sustainability.

Still, it is difficult to see how restructuring of Italy’s debt can be avoided altogether. The alternative – exclusive reliance on a bailout – is tempting, as it may temporarily calm markets. But a bailout would only kick the can down the road. The fact that Greece’s debt problems still have not been resolved should serve as a warning.

In the mildest of scenarios, only Italy’s official debt – held by other governments or international organizations – would be restructured, somewhat limiting the disruptions to financial markets. Yet restructuring official debt may not prove sufficient. Unlike Greece (post-2010), where official creditors held the lion’s share of the debt stock, domestic residents hold most of Italy’s public debt. This places a premium on a strategy that minimizes capital flight (which probably cannot be avoided altogether). At this stage, policymakers should aim for a resolution of Italy’s woes that does not generate additional risks and complications. But there is little reason to expect them to hit the target.

Carmen M. Reinhart is Professor of the International Financial System at Harvard University's Kennedy School of Government.

Read the original article on project-syndicate.org.

More about: Italy