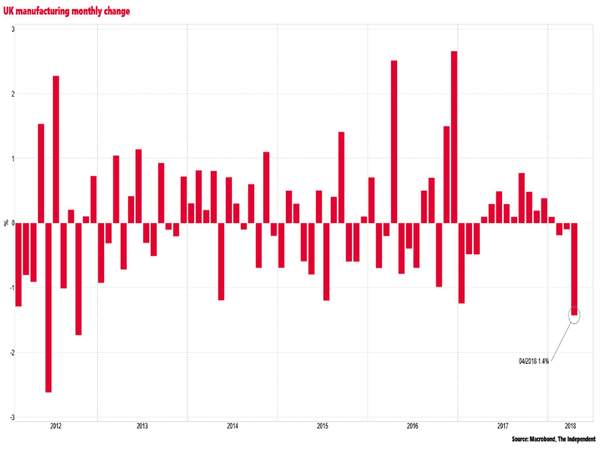

Output from firms fell 1.4 per cent in the month according to the Office for National Statistics, following the 0.1 per cent decline in March. City analysts had expected a 0.3 per cent expansion.

It was the worst monthly performance since October 2012.

The ONS added that there was “widespread weakness” in the sector, with nine of the 13 sub-sectors showing a decline.

The wider industrial sector, which includes energy firms, saw an 0.8 per cent fall, following a 0.1 per cent expansion in March.

The Deputy Bank of England Governor Dave Ramsden said last week that recent survey data was supporting the Bank’s view that GDP growth would bounce back strongly in the second quarter.

But the latest report on manufacturing, which accounts for 10 per cent of UK GDP, suggests otherwise. The pound fell sharply in the wake of the figures, dropping to $1.3373, down 0.3 per cent on the day, as traders scaled back their bets on an August interest rate hike from the Bank.

Weakest since 2012

Construction output was also weaker than expected according to the ONS, growing by just 0.5 per cent, following the 2.3 per cent slump in March.

Rounding off a hat-trick of disappointing news, the ONS separately reported that the goods trade deficit was wider than expected in April at £14.03bn, rather than the £11.35bn City analysts had pencilled in.

On a three monthly basis the value of goods exports, excluding erratics, was down 3.7 per cent, while imports fell 2 per cent

“It is possible that the UK is now moving past the recent sweet spot for exporters, with growth in key markets moderating and the impact of the post-EU referendum slump in sterling, which has helped some exporters, subsiding. The possibility of an escalating trade war has added to the downside risks for exporters,” said Suren Thiru of the British Chambers of Commerce.

The ONS’s analysis of the weakness of the economy in 2018 has been at odds with the Bank of England’s, with the statistics agency identifying underlying weakness, but the Bank attributing the slowdown almost entirely to the “Beast from the East” snowstorms of February and March.

The Bank held off from raising interest rates in May, saying that it would wait to see if its more optimistic view would be bourne out.

In the first quarter GDP growth is estimated to have slumped to just 0.1 per cent, with manufacturing growing by 0.2 per cent, services by 0.3 per cent and constriction slumping by 2.7 per cent.

“The very poor set of April industrial production, construction output and trade data can only fuel Bank of England concerns and uncertainties over the economy and there can be no doubt that the [Bank’s Monetary Policy Committee] will leave interest rates unchanged at their June meeting next week. The data also make an August interest rate hike by the Bank of England look a lot more questionable,” said Howard Archer of the EY Item Club.

More about: Pound