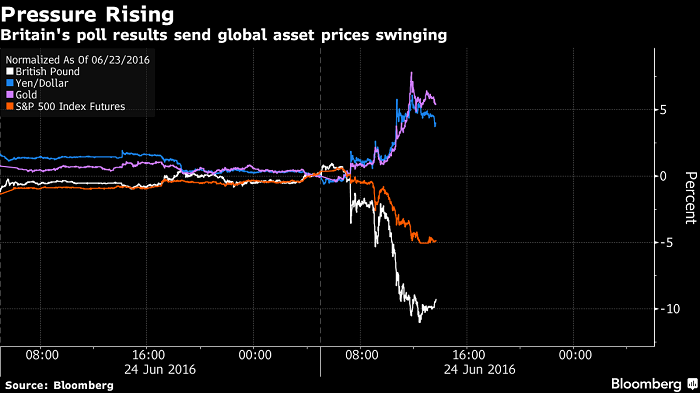

Sterling slid by the most on record and European stocks headed for the biggest drop since 2008 as trading soared. The yen strengthened past 100 per dollar for the first time since 2013, gold rose the most in more than seven years and benchmark Treasury yields had their biggest drop since 2009.

The victory for the "Leave" campaign prompted Prime Minister David Cameron to resign. The outcome stunned many investors who’d put wagers on riskier assets over the past week as bookmakers’ odds suggested the chance of a so-called Brexit was less than one in four.

The final tally, announced just after 7 a.m. London time, showed voters had backed “Leave” by 52 percent to 48 percent. JPMorgan Chase & Co. and HSBC Holdings Plc said the result may prompt them to move thousands of jobs out of London. S&P Global Ratings said the U.K. will lose its AAA credit rating.

Some equity benchmarks and currencies pared losses after Governor Mark Carney said the Bank of England was ready to pump billions of pounds into the financial system to support markets and wouldn’t hesitate to take additional measures if needed.

These are among the most notable moves in global financial markets:

- British pound falls as much as 11 percent to $1.3229, weakest since 1985

- Yen jumps 3.2 percent to 102.85 per dollar, after reaching 99.02

- FTSE 100 Index slides as much as 8.7 percent, most since 2008

- S&P 500 Index futures slump as much as 5.1 percent, triggering a trading curb

- Yield on 10-year Treasuries drops 29 basis points to 1.46 percent

- Gold surges as much as 8.1 percent to $1,358.54 an ounce

- New York crude oil retreats 3.8 percent to $48.20 a barrel, poised for biggest loss since April

- Poland’s zloty, South Africa’s rand drop more than 4 percent per dollar, lead emerging-market currencies lower

Currencies

The pound was down 6.7 percent to $1.3883 as of 10:22 a.m. in London. Its biggest one-day loss prior to that was a move of 4.1 percent recorded in 1992, when the currency was forced out of Europe’s exchange-rate mechanism.

“Market liquidity and overall liquidity in the U.K. is drying up as we speak in a very rapid way,” said John Woods, chief investment officer for Asia-Pacific at Credit Suisse Private Banking, told Bloomberg TV in Hong Kong. “It’s highly likely that we see monetary easing in a coordinated response” from central banks across the world, he said.

The euro slumped 2.3 percent, while currencies in Norway, Sweden and Australia posted even steeper losses.

The zloty fell 1.8 percent against the euro and 4.1 percent per dollar, leading losses in emerging Europe, as Britain’s exit threatened to throttle aid to the bloc’s less-affluent member states. Hungary’s forint dropped 1 percent against the euro.

Stocks

The Stoxx Europe 600 Index tumbled 6.5 percent, with trading volumes more than five times the 30-day average. A gauge of banks led the selloff, declining 13 percent. The FTSE 100 Index slid 4.6 percent. Barclays Plc and Royal Bank of Scotland Group Plc lost more 15 percent.

U.K. construction firms Taylor Wimpey Plc and Bovis Homes Group Plc sank at least 19 percent. EasyJet Plc, the low-cost carrier which gets about half its revenue from European markets excluding the U.K., tumbled 15 percent. Julius Baer Group Ltd. dropped 10 percent after saying market turbulence triggered by Brexit could temporarily hit gross margins at wealth-management firms.

“It’s already been a long day today,” said William Hobbs, head of investment strategy at the wealth-management unit of Barclays in London. “Risk appetite is going to evaporate in the coming days. How long that risk-off will go remains the question. What we would urge clients to remember is that the impact of the U.K. is unhelpful but digestible.”

Commodities

The Bloomberg Commodity Index fell as much as 2.2 percent, the biggest loss in more than a month. Brent crude traded 4.3 percent lower at $48.72 a barrel, after tumbling the most since April 18. Copper slid 1.8 percent.

Gold posted its biggest one-day gain since the financial crisis and silver rallied the most in 18 months.

“Gold has delivered what it promised: doing extremely well in adverse times,” said Dominic Schnider, head of commodities and Asia-Pacific foreign exchange at the wealth-management unit at UBS Group AG in Hong Kong. “Energy and industrial metals, where demand is tied to expectations for global economic growth, were hardest hit by Brexit.

Bonds

A gauge of where bank borrowing costs will be in the months ahead, known as the FRA/OIS spread, hit the most extreme level since 2012. The three-month FRA/OIS spread widened to 0.32 percentage point, compared with 0.27 on Thursday.

“Equity futures, gold, U.K. bank and insurance stocks are all sounding off their market-stress sirens, and the funding market will go into its usual precautionary mode,” said Sean Keane, an Auckland-based analyst at Triple T Consulting and the former head of Asia-Pacific rates trading at Credit Suisse Group AG. “Dollar swap lines with the Federal Reserve may be used, and other central banks will be on alert.”

The cost of insuring investment-grade corporate debt against default surged the most since 2008. The Markit iTraxx Europe Index of credit-default swaps jumped 17 basis points to 92 basis points, according to prices compiled by Bloomberg. A gauge of swaps on sub-investment grade companies climbed the most since October 2014.

The riskiest bonds issued by some European banks posted record declines, based on data compiled by Bloomberg. UniCredit SpA’s 1 billion euros of additional Tier 1 notes fell eight cents on the euro to 76 cents, the lowest since February, while Deutsche Bank AG’s 1.75 billion euros of AT1s fell 5 cents to 78 cents.

Among the largest declines in high-yield bonds were notes sold by U.K. companies reliant on consumer spending. Debt from department-store operator Debenhams Plc and restaurant chain PizzaExpress Ltd. both fell 5 pence to 95 pence, the biggest declines since the two notes were sold in 2014.

Some investment-grade corporate bonds in euros rose amid expectations that the European Central Bank may step up a purchase program. Notes from companies including Veolia Environnement SA, Electricite de France SA and auto-parts market Robert Bosch GmbH increased more than three cents on the euro.