The old adage that every crisis represents an opportunity is certainly true in the case of COVID-19. Now that the pandemic has lasted longer and wrought more destruction than many initially anticipated, it is all the more important that policymakers seize on the positive trends it has incidentally set in motion.

The human tragedies and massive economic disruptions caused by COVID-19 have rightly commanded the attention of the public and policymakers for more than six months, and should continue to do so. But in managing the immediate crisis, we must not lose sight of the opportunities. The oft-quoted line about not letting a crisis go to waste has rarely been more relevant.

The old adage that every crisis represents an opportunity is certainly true in the case of COVID-19. Now that the pandemic has lasted longer and wrought more destruction than many initially anticipated, it is all the more important that policymakers seize on the positive trends it has incidentally set in motion.

For companies, governments, households, and multilateral institutions navigating this unsettling period, the basic task is the same: to overcome pandemic-induced disruptions in ways that also emphasize the silver linings of the crisis. Now is the time to look to lock in trends and conditions that will reshape our society and economy for the better over the long term. With this overarching objective in mind, here are the top six silver linings that I see.

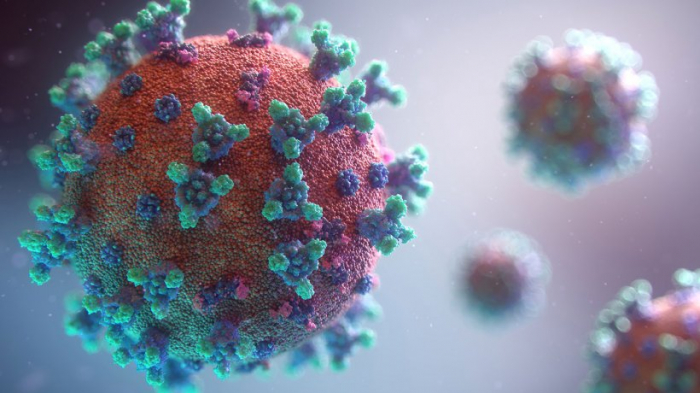

The first is that we are living through one of the most exciting and promising periods of medical invention and innovation in history. While the immediate focus is rightly on COVID-19 vaccines and therapies, we should expect the research currently underway to produce a host of other discoveries, many of which will yield significant, durable benefits. Moreover, the crisis is forcing us to confront a battery of complex issues concerning drug pricing and distribution, both domestically and globally, as well as the range of social and other inequalities that we have allowed to worsen.

Second, deeper cross-border private-sector collaboration, often outside the purview of governments, is fueling this process of scientific leapfrogging. In mobilizing against the coronavirus, scientists around the world are sharing information like never before, and pharmaceutical companies are collaborating in unprecedented ways. These collective efforts are being supported by dynamic public-private partnerships, showing that this instrument of development can indeed be “win-win” when it is properly focused and there is clear alignment.

Third, the economic disruptions resulting from the pandemic have fueled multiple private-sector efforts to collect and analyze a broader range of high-frequency data in domains extending far beyond medicine. In the economics discipline, for example, there is a massive surge of interest in innovative new methods of measuring economic activity through granular high-frequency indicators like mobility (smartphone geolocation), electricity consumption, and retail traffic, as well as credit card usage and restaurant reservations. These metrics are now supplementing the official statistics compiled by governments, providing considerable scope for compare-and-contrast exercises that can improve the quality and policy relevance of data-collection efforts.

Fourth, the COVID-19 shock has raised our collective awareness and sensitivity to low-probability, high-impact “tail risks.” Suddenly, many in the private and public sectors are thinking more in terms of the full distribution of potential outcomes, whereas in the past they focused only on the most likely events. Policymakers have become more open to scenario analyses and the broader range of “if-then” conversations that such analyses elicit.

In the case of climate change – a major risk that some wrongly perceived as a distant tail instead of a baseline – the sharp reduction in harmful emissions during the current crisis has provided clear evidence that a new way is possible. And it is now widely accepted that governments have an important role to play in underwriting a durable and inclusive recovery. The door is open for more public investment in climate mitigation and adaptation, and there is a growing chorus demanding that the new normal be “green.”

This speaks to a fifth silver lining. The pandemic has led country after country to run a series of “natural experiments,” which have shed light on a host of issues that go well beyond health and economics. Systems of governance and modes of leadership have come under scrutiny, revealing a wide divergence in their capacity to respond to the same large shock. These issues have not been limited to the public sector. Corporate responsibility has also been brought to the fore as company after company scrambles to respond to what was once unthinkable. And multilateral cooperation has been shown to be lacking, increasing the threats to all.

Finally, the crisis has required many companies to hold candid conversations about work-life balance and to devise innovative solutions to accommodate employees’ needs. There have already been far-reaching changes in how we work, interact with colleagues, and consume goods and services, and only some of these are likely to be reversed after the pandemic has passed.

Sign up for our weekly newsletter, PS on Sunday

[email protected]

These six silver linings constitute only a preliminary list of the opportunities offered by the pandemic. The point is not to discount the severity of the shock and uncertainty that have confronted the majority of the world’s population. The pandemic has lasted much longer than many expected and continues to leave tragedy and destruction in its path.

But that is all the more reason to make the most out of our collective response. The challenge now is to expand and refine this list, so that we can seize the opportunities on offer and lock in more positive trends for the long term. By acting together, we can transform a period of deep adversity into one of shared wellbeing for us and for future generations.

Mohamed A. El-Erian, Chief Economic Adviser at Allianz, the corporate parent of PIMCO where he served as CEO and co-Chief Investment Officer, was Chairman of US President Barack Obama’s Global Development Council. He is President-Elect of Queens’ College (Cambridge University), senior adviser at Gramercy, and Part-time Practice Professor at the Wharton School at the University of Pennsylvania. He previously served as CEO of the Harvard Management Company and Deputy Director at the International Monetary Fund. He was named one of Foreign Policy’s Top 100 Global Thinkers four years running. He is the author, most recently, of The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse.

Read the original article on project-syndicate.org.

More about: COVID