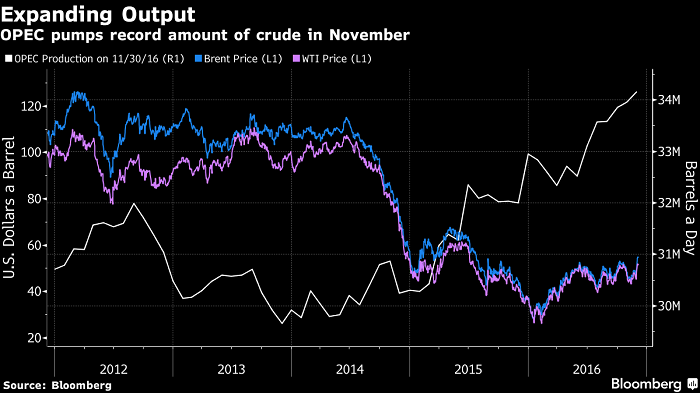

Oil is trading above $51 a barrel after OPEC agreed Wednesday to trim the group’s output by 1.2 million barrels a day by January to stem a supply glut and buoy prices. Russia -- which isn’t part of the bloc -- has also pledged a reduction of as much as 300,000 barrels. Attention is now shifting to which other non-OPEC producers will reduce output when they meet in Vienna on Saturday. OPEC is hoping they will cut a further 300,000 barrels a day.

“The market is taking a breather; it has moved up strongly on sentiment after

the OPEC cut announcement,” Bjarne Schieldrop, chief commodities analyst at SEB Markets in Oslo, said by phone. The increase in production from Nigeria and Libya will be a “headache” and Schieldrop expects OPEC will cut back to 33 million barrels a day rather than its stated target of 32.5 million, he said.

West Texas Intermediate for January delivery lost as much as 87 cents to $50.92 a barrel on the New York Mercantile Exchange, and was at $51.53 at 10:29 a.m. in London. The contract rose 0.2 percent to $51.79 on Monday, the highest close since July 2015. Total volume traded was about 15 percent above the 100-day average.

Vienna Meeting

Brent for February settlement lost as much as 59 cents, or 1.1 percent, to $54.35 a barrel on the London-based ICE Futures Europe exchange. The contract on Monday gained 48 cents to $54.94, also the highest close since July 2015. The global benchmark crude traded at a $2.27 premium to February WTI.

Other invitees to the meeting on Saturday include Oman, Bahrain, Colombia, Egypt, Trinidad and Tobago, Turkmenistan, Azerbaijan and Brunei. Altogether, the 14 nations pumped about 18.8 million barrels a day of oil last year, equivalent to 20 percent of global supply, according to data from BP Plc.