“People react jumpy to Gazprom reducing supplies all the time, often with a valid reason,” said Sijbren de Jong, a strategic analyst at The Hague Center for Strategic Studies. “But here it’s difficult to determine if something more is going on.”

Day-ahead gas on the Title Transfer Facility in the Netherlands, Europe’s biggest market for the fuel, rose 17 percent last week, the biggest gain since April, according to broker data compiled by Bloomberg. The close at 23 euros a megawatt-hour ($7.25 a million British thermal units) was the highest since April 2015.

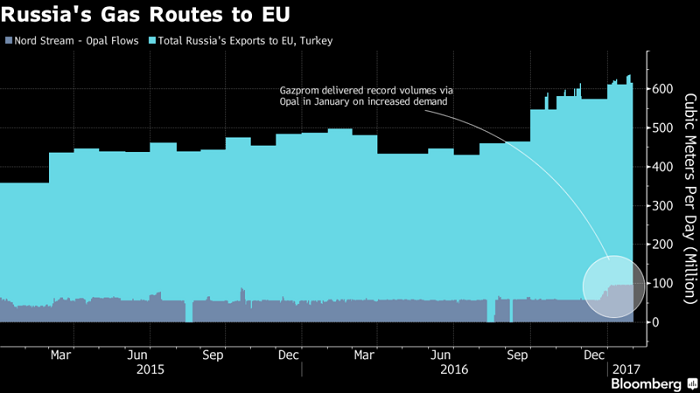

Gazprom only increased flows through Opal in December after the European Commission eased some limits after years of disputes on the use of the pipeline, which is seen as a threat by transit nations including Poland and Ukraine because it can bypass their roles in transit to western Europe. Poland successfully challenged the commission’s decision and Gazprom returned to using about half of Opal’s capacity from Feb. 1.

Some traders may face a cut in Gazprom supplies down to contractual volumes if they increased orders now, Russia’s Kommersant newspaper reported Thursday, citing people with knowledge of the matter it didn’t identify. The company’s press service declined to comment.

While there’s no substantial risk to Russian gas shipments, or European gas supply as a whole, prices “could rise more aggressively if the weather turns cold over February,” said Christopher Haines, head of oil and gas at BMI Research.

After the worst cold blast in a decade and a warmer than usual start to February, temperatures are expected to fall below the seasonal average throughout Europe. The northwest European average is forecast to be 0.4 degrees Celsius next week (33 Fahrenheit), compared with a 10-year mean of 3.3 degrees Celsius.

European gas storage levels have been drained below 5-year averages after January’s abnormally chilly temperatures. Meanwhile, there has been a dearth of liquefied natural gas imports, with the U.K., Netherlands and Belgium receiving just four cargoes in 2017 through Friday, compared with 13 in the same period last year.

“Higher prices on European benchmarks will pull in more LNG, particularly as Asian prices soften,” Haines said.

- Spot liquefied natural gas in northeast Asia fell to $7.50 per million Btu units on Jan. 30 from $7.85 a week before, according to assessments by Energy Intelligence

- The day-ahead gas contract in the U.K. gained 17 percent last week to about $7.60 a million Btu on Friday, according to broker data compiled by Bloomberg

-The Opal pipeline, which is co-owned by Gazprom and BASF SE’s Wintershall AG subsidiary, runs for 472 kilometers (293-mile) from the arrival point of the Nord Stream link on Germany’s Baltic coast toward the Czech Republic. It has a capacity of 36 billion cubic meters of gas a year, with actual supplies of 20 billion cubic meters in 2016

- The EU and Dusseldorf courts handling Poland’s claims don’t disclose hearing schedules. While the procedures may drag on, there could be some interim solution that will allow Gazprom to use more capacity “in emergency situations,” said BMI’s Haines

/Bloomberg/