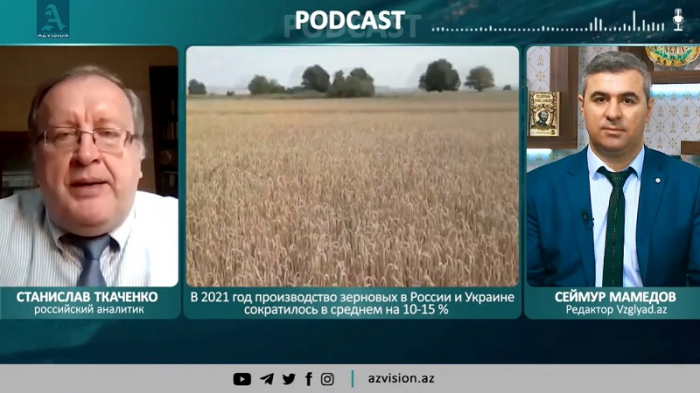

Today a number of experts, leading international organizations, politicians and governments agitate that the world is on the doorstep of a global food crisis. Professor of Saint Petersburg State University, Doctor of Economic Sciences Stanislav Tkachenko spoke about the roots, causes, and possible solutions to the food crisis in his interview with AzVision.az.

Historically, there have been times when food production exceeded consumption. The opposite of this also happened. For long-term consideration, the situation was balanced until 2008. Although several productive years were replaced by non-productive years, food stocks enabled them to control these fluctuations. The starting point of the current global crisis must be taken from 2008, which was marked by a global economic crisis. At that time, the amount of money supply in big countries significantly rose, leading to a further increase in food prices. The crisis resulted in a reduction in agricultural production. So, the tendency for food price to increase is being observed after 2008. The rising demand for agricultural products is limited to various parts of the planet - China, India, and Russia. Other states are not important for now. The food crisis in its current form has been going on for almost 15 years.

Why is the world food system significantly affected by the Russia-Ukraine crisis and the Western economic war against Russia?

There are several causes. Firstly, it is necessary to take into account that after 2020, which was very successful for farmers, 2021 was not so successful all over the world, including Russia and Ukraine. Wheat production decreased by 10-15% on average and both countries entered 2022 with small reserves and exports.

Secondly, there is high confidence in the market about what this year's product will look like under the ongoing military operations. Skeptics claim that Ukraine's exports will be virtually zero by 2022. So, it is necessary to cross off the products that Ukraine supplies to the world market. I want to restate that Ukraine produces 26 million tons of wheat currently and sells 15-17 million tons of this amount.

Everyone is worried about when they will be removed from the world market. The same can be said about Russia. However, according to some objective indicators, the Russian government says that 2022 will be as successful as 2020. Therefore, there is no particular concern in Moscow. The main problem is about wheat production in Ukraine and Russia's ability to export its wheat through the Black Sea straits.

- What will be the first damage from Russian and Ukrainian wheat importers?

- The world wheat market is divided into geographical segments. Therefore, Russia supplies its grain to a limited number of countries, primarily the Middle East. Today, Egypt is the largest importer of Russian wheat, but other North African countries are also big exporters. Hence, the countries in this region will probably be the first to suffer. However, the market is still interconnected, which means that there will be other grain sellers in Egypt. Russian grain can be replaced by European grain, although it can be expensive and more logistically difficult to supply on new routes. A decrease in supply in one country will affect the markets of other countries, both in terms of supply and demand, even if these countries have never bought Russian or Ukrainian grain.

-

- Europe is one of the world's largest grain exporters. Can Ukrainian and Russian wheat importers rely on European support?

- Everything can be expected. The fact is that over the past 30 years, Europeans have been persistently reducing grain production. The European Union has special programs funded by Brussels, based on which farmers are paid extra to avoid grain production. Due to the lack of demand, the level of crop losses in Europe is at a record level. For this reason, in principle, Europe has a great potential to increase grain supplies to markets. There are problems, historically, grain production in Europe has been subsidized. Until 2008, or even earlier, around the beginning of the 21st century, the United States forced the EU to reduce subsidies to grain farmers. Europeans also started to reduce, move away from grain production, and develop "green tourism" in the areas of former farms. Therefore, there were difficulties with the rapid surge in grain production in Europe. The problem is that Europeans can produce more, but they don't want to. Hence, if farmers are forced to produce more, they will demand an increase in subsidies from EU officials. The EU, on the other hand, cannot always increase the redistribution of funds through its budget for the sake of a Unified Agricultural Policy.

- India is trying to replace Russia and Ukraine in about 30 wheat importing countries, including Azerbaijan. How do you assess its agricultural potential in this area?

- If we talk only about the wheat sector, then it should be noted that the largest wheat producers in the world are China and India. Russia ranks third largest wheat producer, followed by the United States. I want to talk about a few figures. Last year, China produced 134 million tons, India 107 million tons and Russia 83 million tons of grain. However, it should not be forgotten that India has a population 10 times larger than Russia's, and is in dire need of grain to provide for both the population and the animals. India has the technical potential to export and can offer something to the world wheat market. On the other hand, the Indian government needs to think about what to replace this wheat within the domestic market. Hence, some experts do not consider India a serious exporter. Nevertheless, India is a net importer of not only wheat but also other products such as corn. Therefore, India can export a certain amount, but not tens of millions of tons, but millions of tons.

- Can Kazakhstan replace Ukraine as a supplier of wheat and sunflower oil for the countries in need?

- Kazakhstan has serious potential in wheat production. Kazakhstan annually grows 13 million tons of wheat and, according to official statistics, exports about 7 million tons of grain. However, some of the sown areas are not used, many areas have been withdrawn from circulation since the collapse of the USSR, so technically it must increase its share in the grain market. On the other hand, the Kazakh government needs to know why it needs to do so, because the grain market is in a state of constant volatility, with periods of growth and decline. Therefore, this is a rather risky step., Notwithstanding, Kazakhstan has significant potential for grain exports, in any case, it can export significant volumes to neighbouring countries.

When it comes to Kazakh sunflower oil, here we are dealing with a state with zero balance. Kazakhstan annually produces 147,000 tons of refined and 183,000 tons of unrefined oil. It exports about 15% of its output, but imports the same amount, mainly from Russia. Therefore, increasing the production of sunflower oil is an important problem for Kazakhstan. They do not consider it a problem yet, so they must first understand this challenge, work on it, and then move on to solving it. After all, historically, in many parts of the world, they did not even know about the presence of sunflower oil, the population used cotton, rapeseed and olive and other oils. Hence, the markets for sunflower oil are mainly in Europe, but they are relatively small compared to the global market for vegetable oils, they need to be expanded, creating additional incentives for producers. Today, the undisputed leader in the sunflower oil market in Ukraine annually produces more than 1 million tons of refined oil and about 2.5 million tons of unrefined oil. Kazakhstan, with about 320,000 tons of oil, exports less than Ukraine. On the other hand, if favorable conditions are created, Kazakhstan can export tens of thousands of tons of sunflower oil every year.

- Is Kazakhstan willing to increase exports of wheat and sunflower oil to the world market? As far as I know, Kazakhstan has an export quota for wheat ...

- Quotas are outside the Eurasian Economic Union, and the movement of goods, including food, is free in the EU. But Kazakhstan, like Ukraine, has a problem with the EU. In the past, Brussels allocated them annual quotas for the import of sunflower oil, which were selected in January, and then producers in these countries throughout the year considered that they could sell vegetable oil anywhere else in the world. Now there is a severe shortage of sunflower oil in the EU, where a great demand is recorded for this oil and prices have increased. This is ideal for the producer and, of course, undesirable for the consumer. In this case, the producer may rush to invest in the production of sunflower and oil. The productivity period between investment and production in this area is shorter than in other industries. Therefore, I think it is realistic to increase the production of sunflower oil in Kazakhstan in two years to expand exports.

- How can the Caspian littoral countries minimize the consequences of the impending food crisis? What issues need to be addressed in such a situation?

- In this situation, there is a sufficient set of standard measures that any government must implement. If we move from the general measures to the specific measures, then the general one is to expand the production of agricultural products at any cost. This is an axiom in terms of national, including food security, and it is now recommended in public administration textbooks that any state develop local production, regardless of cost. The reason is that it is the most reliable guarantee of food security.

However, if we go beyond this recommendation, there are two main directions, as some countries are unable to produce certain agricultural products due to the climate. First: creating a stockpile of strategic agricultural products to supply markets. This sounds surprising, but half of the world's grain reserves are in China. Concerned about food security, China is building huge warehouses for wheat and other grains. Today, China accounts for one-fifth of the world's population and holds half of its food reserves. Second, governments need to create conditions to encourage food imports into the country.

In other words, we need to talk about a system of subsidizing the import of important food products. The state must understand that to ensure security, it is necessary to provide soft loans to importers. Even in critical situations, it is necessary to co-finance the supply of food to the domestic market to prevent price increases. Because no state can resist long-term trends: if food prices continue to climb in the world, each country will record price increases. But the more important task is to avoid price spikes, like in Europe today. If food prices increase by 40% in a month, of course, it is impossible not to notice it. Today, the task of the governments of the Caspian littoral states is to prevent food shortages and sharp price increases, ie to be ready to subsidize production, help importers and create strategic reserves of basic food products.

- What do you forecast? What happens next? Has the world entered a sharp and long-lasting food crisis?

- I think we are entering a period when food prices will be high. This is primarily due to excessive liquidity in the world. During the COVID-19 pandemic, most governments printed large amounts of money and are now trying to raise interest rates to drive the unsupported part of the money supply out of the market. This is not happening for various macroeconomic reasons, so the prices of goods and services continue to rise, but employment does not increase. For this reason, I think we are entering a period of high food prices, and if we look at the last 50 years, such periods usually last about 3 -5 years.

But at the same time, individual states can avoid market shocks and settle food and other issues within the framework of certain special relations, and multilateral relations with other countries. In the EU, such problems are solved by creating a single market for agricultural products. We know that Azerbaijan and Russia are currently implementing many programs to launch Agroexpress between the countries and create additional conditions for the rapid and trouble-free trade of agricultural products in terms of bureaucracy. In other words, it is necessary to be patient with high prices, but the government must also take flexible and operative steps to increase food production in the domestic market and thus prevent the rise in food prices.

More about: