Oil has gained about 17 percent since the members of the Organization of Petroleum Exporting Countries agreed Nov. 30 to trim output for the first time in eight years. The deal reached over the weekend in Vienna between the group and non-OPEC producers encompasses countries that produce about 60 percent of the world’s crude. Shale output from seven U.S. fields is projected to increase next month, according to a government report.

“Any sustainable rally will be difficult to maintain given the risk of returning production and questions about compliance,” said David Lennox, a resources analyst at Fat Prophets in Sydney. “There will be ample supply returning with a price consistently between $55 and $60, and that’s part of the reason why we haven’t seen the price rocket.”

West Texas Intermediate for January delivery fell 6 cents to $52.77 a barrel on the New York Mercantile Exchange at 9:01 a.m. in London. Prices gained $1.33 to close at $52.83 a barrel on Monday, capping a 6.2 percent gain over three sessions. Total volume traded was about 20 percent above the 100-day average.

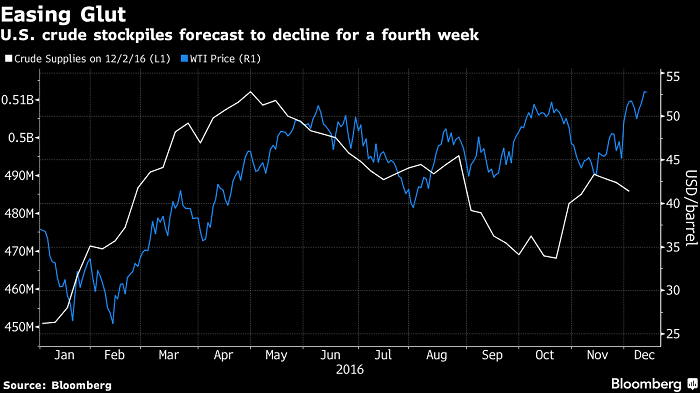

U.S. Stockpiles

Brent for February settlement lost 3 cents to $55.66 a barrel on the London-based ICE Futures Europe exchange. The contract climbed $1.36 to $55.69 on Monday, the highest close since July 2015. The global benchmark crude traded at a $1.91 premium to February WTI.

See also: OPEC-Russia deal could drain almost half the global oil surplus

U.S. crude inventories probably decreased by 1.5 million barrels last week for a fourth straight drop, according to a Bloomberg survey before an Energy Information Administration report on Wednesday. Supplies are at the highest seasonal level in weekly data compiled by the EIA since 1982.

Oil stockpiles will decline by about 600,000 barrels a day in the next six months as curbs by OPEC and its partners take effect, said the IEA, which had previously assumed inventories wouldn’t drop until the end of 2017. Russia, the biggest producer outside OPEC to join the deal, will gradually implement the full reduction it promised, according to the IEA.

More about: