Why has everybody been so wrong about oil? Well, three words: supply and demand.

First, people underestimated how much all the new shale oil that`s come online the past few years would push down prices. Then they didn`t expect the Saudis to keep up their own supply level in response. And finally, they didn`t realize how much less demand there`d be now that, outside the United States, the global economy is cooling off. Indeed, Russia is imploding, Brazil is struggling and even China is slowing down, all while Europe is trying to drag itself out of a depression and Japan is throwing hurdles in front of its nascent recovery by raising its own sales tax.

Add it all up, and economist Jim Hamilton estimates that lower demand accounts for 44 percent of lower oil prices. That`s how you get an oil glut of 1.5 to 2 million barrels per day in the macroeconomic equivalent of overnight.

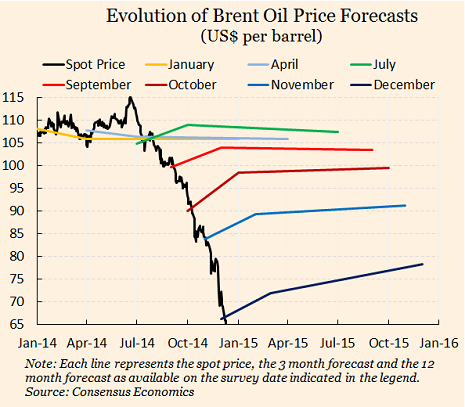

That leaves one last question: Did Buffett get out at the right time? Or have prices already bottomed? It`s tempting to say that they have now that oil has rebounded from $49 a few weeks ago to $59 today, but that`s probably going a bit too far.

That`s because lower prices should make higher-cost production, like fracking, unprofitable enough that companies stop drilling, pushing supply down and prices up. There`s already some of that going on. U.S. rig counts are falling fast. But despite that, production isn`t, and, according to Goldman Sachs, might not for awhile. Why? Well, part of it is that shale is getting more efficient. But another part is the debt. Oil companies borrowed $200 billion to expand their drilling during the boom, so they can`t afford to stop drilling during the bust. If they did, they wouldn`t have any money coming in, but they would still have to send their nonexistent money out to pay back what they owe. This is called bankruptcy. So the only thing they can do is keep drilling, and then store their oil in the hope that the price will recover.

That`s why production shouldn`t fall that much even if prices do, and why it`s hard to see prices getting above $70 anytime soon. Just don`t call that a prediction.

More about: