The latest debt-ceiling drama playing out in Washington is more worrying than usual. Even if President Joe Biden and congressional Republicans come to terms, the economic and financial damage could be severe, especially if the world loses patience with a US political system that appears to lack adequate guardrails.

Is American politics so dysfunctional that the United States government can’t even pay its bills on time? That is the central question behind the latest debt-ceiling drama playing out in Washington. So far, efforts to increase the country’s borrowing limit suggest the answer could very well be yes.

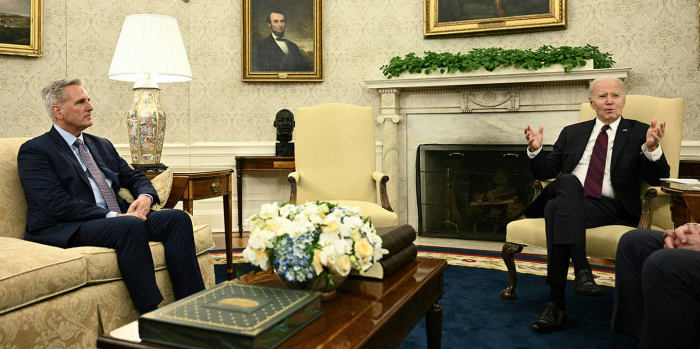

The first sign of dysfunction is that elected officials have only just started talking to each other. The US is barreling toward a catastrophic default next month, and yet President Joe Biden, House Speaker Kevin McCarthy, and other congressional leaders did not meet to discuss the situation until May 9, and a second meeting, set for May 12, was postponed.

Biden’s refusal to negotiate has been another cause for concern. He wants Congress to lift the debt ceiling without any accompanying conditions, including cuts to federal spending. While Biden may be right on the merits, the US system of government does not always settle disputes based on who is right on the merits.

It has long been clear that the Republican majority in the House of Representatives was unwilling to pass a “clean” increase in the borrowing limit. They want conditions attached. On May 6, 43 Republican senators released a letter stating that they would not vote to increase the debt ceiling “without substantive spending and budget reforms.”

Biden may have assumed that the Republicans wouldn’t be organized enough to coalesce around a coherent set of demands. To be sure, the House Republicans are chaotic, requiring more than four days and 15 rounds of voting simply to elect a speaker in January. But the House passed a bill over two weeks ago that would raise the debt ceiling, reduce the growth of federal spending, strengthen work requirements in safety-net programs, and reform energy regulation and permitting, among other provisions. Moreover, Republicans in the Senate have supported the House’s efforts and stand firmly behind the debt bill, which should be the basis of negotiations. Biden needs to soften his stance.

Also worrisome is the bipartisan agreement not to reduce future spending on Social Security and Medicare. The nonpartisan Congressional Budget Office expects these two programs to drive up spending as a share of annual economic output by 0.7 percentage points over the next ten years. But Republicans are focusing on cuts to budget categories that are already projected to shrink, like education, housing assistance, and funding for federal law enforcement. While Republicans are right to rein in those categories of federal spending, they need to match their rhetoric with action – namely, cuts to the programs that drive America’s debt.

Even if Biden and the leaders of the House and Senate can agree on a deal, it still must pass both chambers. McCarthy will have to convince his caucus that it is the best possible outcome. He could most likely wrangle most Republican members, but the minority of chaos agents in the House might go so far as to threaten his speakership if they are dissatisfied with the deal.

Of course, signs of political dysfunction can mark a route that ultimately ends in compromise. But such a path must be traveled quickly. Even if Congress and the President raise the debt ceiling in time, waiting until the eleventh hour and flirting with default would have serious economic and financial consequences: a plunging stock market, falling consumer confidence, interest-rate hikes, taxpayers on the hook for billions of dollars in additional interest payments, and the beginnings of a global financial crisis. Financial markets already are beginning to reflect the current lack of progress, with large increases in short-term interest rates.

There is even more at stake than that. If Congress and Biden fail to lift the cap before the US runs out of money, it would be another indication that the American political system lacks adequate guardrails. A president refusing to negotiate with Congress over a matter that is urgent and critically important is a sign of failure, as is a speaker whose job could be held hostage by a small minority of his caucus.

The corrosion of norms and the lack of seriousness in Washington could unleash an economic disaster. This would follow on the heels of the January 6, 2021, insurrection and all that surrounded it – the first time in American history that a president tried to use his office to prevent the peaceful transfer of power after losing an election.

Foreign leaders and global investors would look at the US and see a damning portrait. In this broken system, many elected officials do not respect the results of a presidential election and permit policy and ideological differences to stand in the way of honoring the government’s financial obligations. Investors would think harder about allocating capital to US entities, and America’s role as a beacon of liberal values – including free markets – would be severely undermined.

To whom would the world then turn? There is no obvious candidate. But the absence of a better alternative is a thin reed for national greatness and global economic and political leadership. Sooner or later, it will be gone.

Michael R. Strain, Director of Economic Policy Studies at the American Enterprise Institute, is the author, most recently, of The American Dream Is Not Dead: (But Populism Could Kill It) (Templeton Press, 2020).

More about: